Wireless Communication

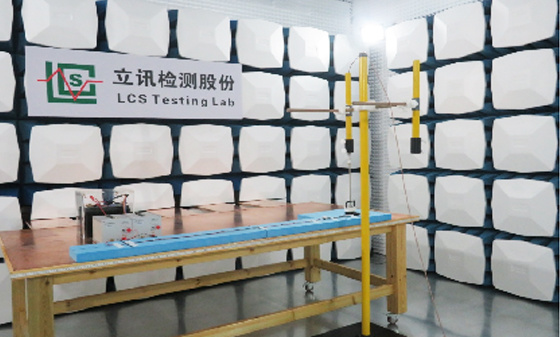

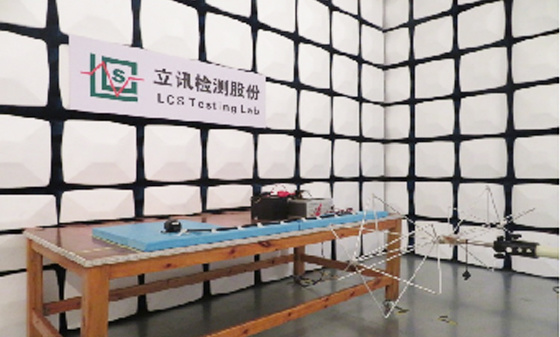

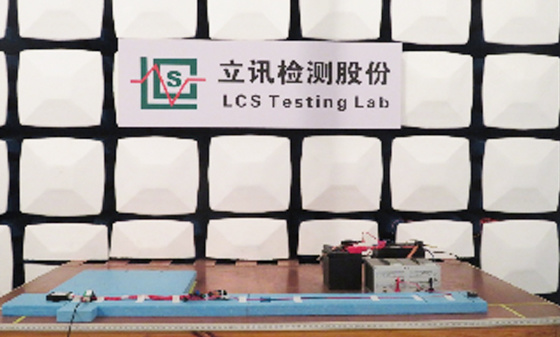

Electromagnetic compatibility

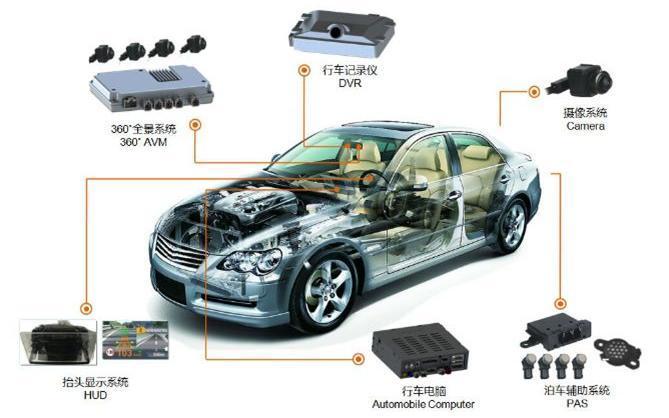

Automotive Electronics

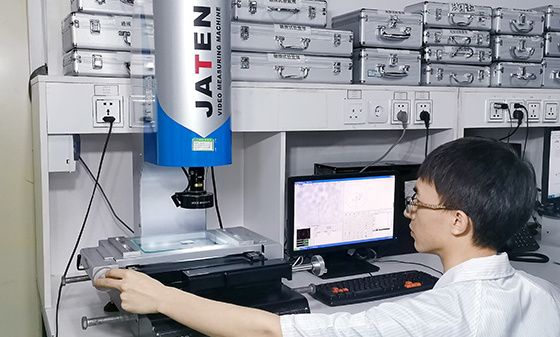

Automotive Parts Inspection

Electronic appliances

Chemical Testing

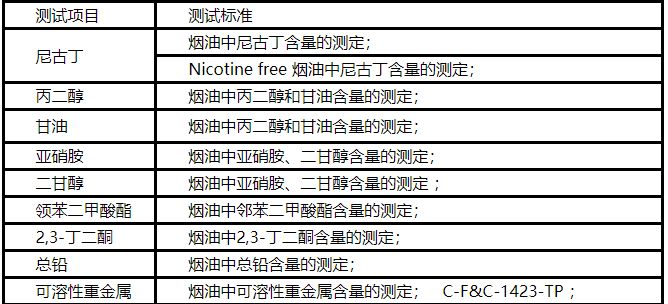

Electronic Cigarette Testing

Reliability testing

Environmental Testing

Battery Testing

Lamp Inspection

Children's toy testing

China Certification

Asia Certification

European Certification

North American Certification

Middle East Certification

Australia Certification

Africa Certification

Registration and filing of wireless communication products

Energy efficiency registration and filing

Registration and filing of chemical products

Management System Standards Training

TRAINING

system certification

Laboratory design and construction

Wireless product testing

BQB testing

Audio/Video, Information and Communication Technology Equipment

inverter

Power supply for control transformers and built-in control transformers

Medical Electrical Equipment

Electrical equipment for measurement, control, and laboratory use

(Safety regulations for lighting appliances) Machinery

(Safety regulations for lighting appliances) Thermology

Electricity (Safety Regulations for Lighting Appliances)

(Safety regulations for lighting appliances) Materials

Electromagnetic compatibility (EMC) testing

Lamp performance testing

Photometer test (IES test)

Photobiosafety testing

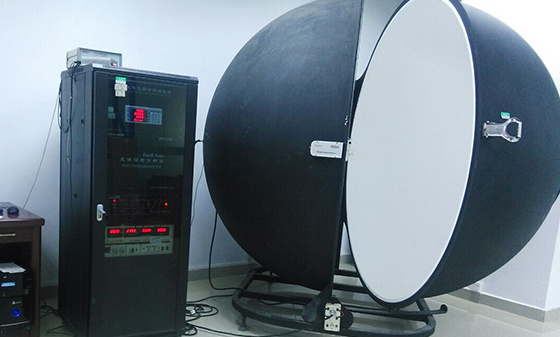

Integral Ball Test

(Safety regulations for lighting appliances) Optics

Smart Home Product Testing

Basic testing of household appliances

Structural inspection

Kitchen appliance testing

Beauty and Hair Testing

Household appliance testing

Energy saving testing of household appliances

Switch product inspection

Plug and socket detection

Electronic control device detection

Automotive interior and exterior components (non electronic and electrical components) - Physical performance testing

Automotive interior and exterior trim - Environmental testing

Automotive interior and exterior components (non electronic and electrical components) - Material aging performance testing

Automotive interior and exterior decorations (electronic and electrical components) - IP protection

Packaging Material Testing - ISTA 1A-6A

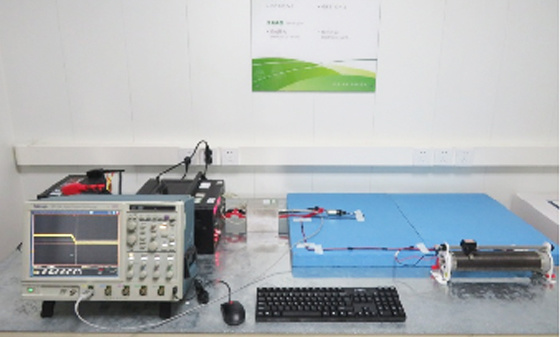

Automotive electronic and electrical components - Electrical performance

Automotive interior and exterior trims - Mechanical performance testing

E-mark certification

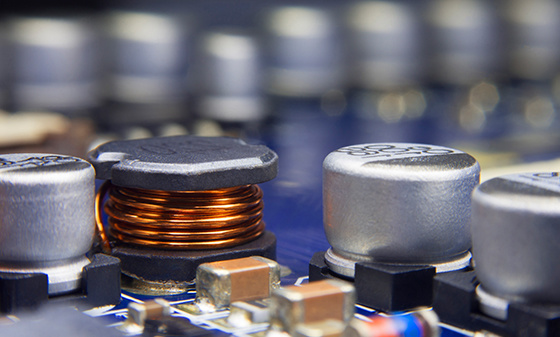

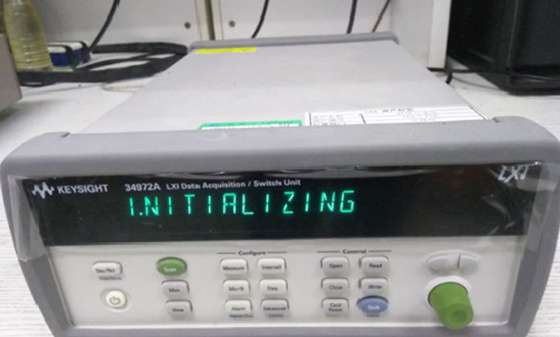

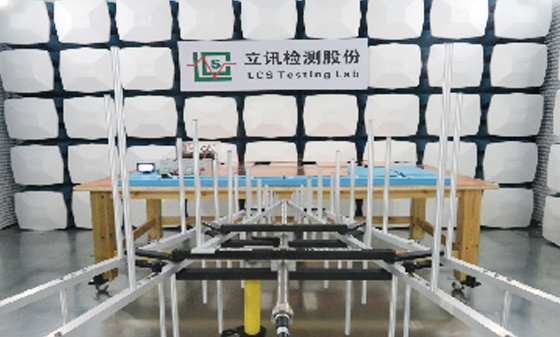

EMC Testing

Electrical performance testing

Hazardous substance testing

Consumer Product Chemistry

Ecological textile testing

Inspection of luggage and shoe materials

Food contact material testing

Testing of infant and toddler products

Toy product testing

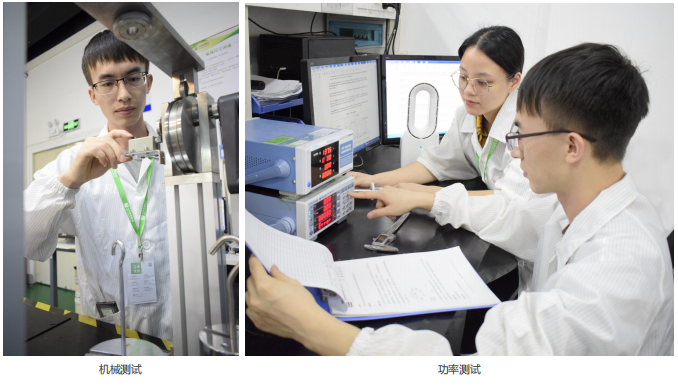

Mechanical inspection

Temperature, humidity and other weather resistance testing

Noise and Vibration

Environmental consulting services

wastewater

Air and exhaust gas

Soil and sediment

solid waste

Battery performance testing

Portable device battery testing

Portable electric vehicle battery testing

Energy storage battery detection

Child protective packaging testing

battery test

EMC testing

Security testing

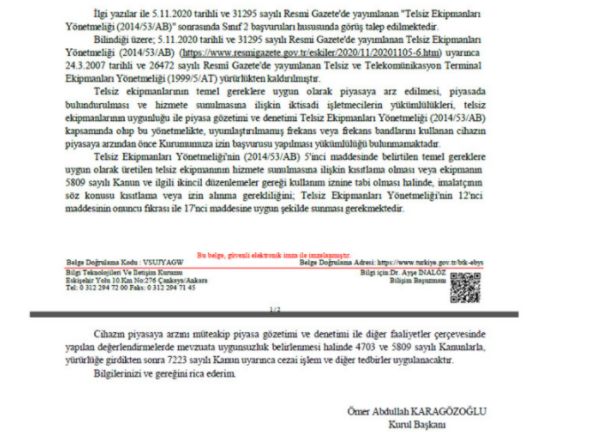

Notification, Certification, and Compliance

Consumer Product Testing/Notification Services - Electronic Cigarette Special Section

Chemical testing

Wireless Communication

Electromagnetic compatibility

Automotive Electronics

Automotive Parts Inspection

Electronic appliances

Chemical Testing

Electronic Cigarette Testing

Reliability testing

Environmental Testing

Battery Testing

Lamp Inspection

Children's toy testing

China Certification

Asia Certification

European Certification

North American Certification

Middle East Certification

Australia Certification

Africa Certification

Registration and filing of wireless communication products

Energy efficiency registration and filing

Registration and filing of chemical products

Management System Standards Training

TRAINING

system certification

Laboratory design and construction

Wireless product testing

BQB testing

Audio/Video, Information and Communication Technology Equipment

inverter

Power supply for control transformers and built-in control transformers

Medical Electrical Equipment

Electrical equipment for measurement, control, and laboratory use

(Safety regulations for lighting appliances) Machinery

(Safety regulations for lighting appliances) Thermology

Electricity (Safety Regulations for Lighting Appliances)

(Safety regulations for lighting appliances) Materials

Electromagnetic compatibility (EMC) testing

Lamp performance testing

Photometer test (IES test)

Photobiosafety testing

Integral Ball Test

(Safety regulations for lighting appliances) Optics

Smart Home Product Testing

Basic testing of household appliances

Structural inspection

Kitchen appliance testing

Beauty and Hair Testing

Household appliance testing

Energy saving testing of household appliances

Switch product inspection

Plug and socket detection

Electronic control device detection

Automotive interior and exterior components (non electronic and electrical components) - Physical performance testing

Automotive interior and exterior trim - Environmental testing

Automotive interior and exterior components (non electronic and electrical components) - Material aging performance testing

Automotive interior and exterior decorations (electronic and electrical components) - IP protection

Packaging Material Testing - ISTA 1A-6A

Automotive electronic and electrical components - Electrical performance

Automotive interior and exterior trims - Mechanical performance testing

E-mark certification

EMC Testing

Electrical performance testing

Hazardous substance testing

Consumer Product Chemistry

Ecological textile testing

Inspection of luggage and shoe materials

Food contact material testing

Testing of infant and toddler products

Toy product testing

Mechanical inspection

Temperature, humidity and other weather resistance testing

Noise and Vibration

Environmental consulting services

wastewater

Air and exhaust gas

Soil and sediment

solid waste

Battery performance testing

Portable device battery testing

Portable electric vehicle battery testing

Energy storage battery detection

Child protective packaging testing

battery test

EMC testing

Security testing

Notification, Certification, and Compliance

Consumer Product Testing/Notification Services - Electronic Cigarette Special Section

Chemical testing

Wireless Communication

Electromagnetic compatibility

Automotive Electronics

Automotive Parts Inspection

Electronic appliances

Chemical Testing

Electronic Cigarette Testing

Reliability testing

Environmental Testing

Battery Testing

Lamp Inspection

Children's toy testing

China Certification

Asia Certification

European Certification

North American Certification

Middle East Certification

Australia Certification

Africa Certification

Registration and filing of wireless communication products

Energy efficiency registration and filing

Registration and filing of chemical products

Management System Standards Training

TRAINING

system certification

Laboratory design and construction

Wireless product testing

BQB testing

Audio/Video, Information and Communication Technology Equipment

inverter

Power supply for control transformers and built-in control transformers

Medical Electrical Equipment

Electrical equipment for measurement, control, and laboratory use

(Safety regulations for lighting appliances) Machinery

(Safety regulations for lighting appliances) Thermology

Electricity (Safety Regulations for Lighting Appliances)

(Safety regulations for lighting appliances) Materials

Electromagnetic compatibility (EMC) testing

Lamp performance testing

Photometer test (IES test)

Photobiosafety testing

Integral Ball Test

(Safety regulations for lighting appliances) Optics

Smart Home Product Testing

Basic testing of household appliances

Structural inspection

Kitchen appliance testing

Beauty and Hair Testing

Household appliance testing

Energy saving testing of household appliances

Switch product inspection

Plug and socket detection

Electronic control device detection

Automotive interior and exterior components (non electronic and electrical components) - Physical performance testing

Automotive interior and exterior trim - Environmental testing

Automotive interior and exterior components (non electronic and electrical components) - Material aging performance testing

Automotive interior and exterior decorations (electronic and electrical components) - IP protection

Packaging Material Testing - ISTA 1A-6A

Automotive electronic and electrical components - Electrical performance

Automotive interior and exterior trims - Mechanical performance testing

E-mark certification

EMC Testing

Electrical performance testing

Hazardous substance testing

Consumer Product Chemistry

Ecological textile testing

Inspection of luggage and shoe materials

Food contact material testing

Testing of infant and toddler products

Toy product testing

Mechanical inspection

Temperature, humidity and other weather resistance testing

Noise and Vibration

Environmental consulting services

wastewater

Air and exhaust gas

Soil and sediment

solid waste

Battery performance testing

Portable device battery testing

Portable electric vehicle battery testing

Energy storage battery detection

Child protective packaging testing

battery test

EMC testing

Security testing

Notification, Certification, and Compliance

Consumer Product Testing/Notification Services - Electronic Cigarette Special Section

Chemical testing

Wireless Communication

Electromagnetic compatibility

Automotive Electronics

Automotive Parts Inspection

Electronic appliances

Chemical Testing

Electronic Cigarette Testing

Reliability testing

Environmental Testing

Battery Testing

Lamp Inspection

Children's toy testing

China Certification

Asia Certification

European Certification

North American Certification

Middle East Certification

Australia Certification

Africa Certification

Registration and filing of wireless communication products

Energy efficiency registration and filing

Registration and filing of chemical products

Management System Standards Training

TRAINING

system certification

Laboratory design and construction

Wireless product testing

BQB testing

Audio/Video, Information and Communication Technology Equipment

inverter

Power supply for control transformers and built-in control transformers

Medical Electrical Equipment

Electrical equipment for measurement, control, and laboratory use

(Safety regulations for lighting appliances) Machinery

(Safety regulations for lighting appliances) Thermology

Electricity (Safety Regulations for Lighting Appliances)

(Safety regulations for lighting appliances) Materials

Electromagnetic compatibility (EMC) testing

Lamp performance testing

Photometer test (IES test)

Photobiosafety testing

Integral Ball Test

(Safety regulations for lighting appliances) Optics

Smart Home Product Testing

Basic testing of household appliances

Structural inspection

Kitchen appliance testing

Beauty and Hair Testing

Household appliance testing

Energy saving testing of household appliances

Switch product inspection

Plug and socket detection

Electronic control device detection

Automotive interior and exterior components (non electronic and electrical components) - Physical performance testing

Automotive interior and exterior trim - Environmental testing

Automotive interior and exterior components (non electronic and electrical components) - Material aging performance testing

Automotive interior and exterior decorations (electronic and electrical components) - IP protection

Packaging Material Testing - ISTA 1A-6A

Automotive electronic and electrical components - Electrical performance

Automotive interior and exterior trims - Mechanical performance testing

E-mark certification

EMC Testing

Electrical performance testing

Hazardous substance testing

Consumer Product Chemistry

Ecological textile testing

Inspection of luggage and shoe materials

Food contact material testing

Testing of infant and toddler products

Toy product testing

Mechanical inspection

Temperature, humidity and other weather resistance testing

Noise and Vibration

Environmental consulting services

wastewater

Air and exhaust gas

Soil and sediment

solid waste

Battery performance testing

Portable device battery testing

Portable electric vehicle battery testing

Energy storage battery detection

Child protective packaging testing

battery test

EMC testing

Security testing

Notification, Certification, and Compliance

Consumer Product Testing/Notification Services - Electronic Cigarette Special Section

Chemical testing

Wireless Communication

Electromagnetic compatibility

Automotive Electronics

Automotive Parts Inspection

Electronic appliances

Chemical Testing

Electronic Cigarette Testing

Reliability testing

Environmental Testing

Battery Testing

Lamp Inspection

Children's toy testing

China Certification

Asia Certification

European Certification

North American Certification

Middle East Certification

Australia Certification

Africa Certification

Registration and filing of wireless communication products

Energy efficiency registration and filing

Registration and filing of chemical products

Management System Standards Training

TRAINING

system certification

Laboratory design and construction

Wireless product testing

BQB testing

Audio/Video, Information and Communication Technology Equipment

inverter

Power supply for control transformers and built-in control transformers

Medical Electrical Equipment

Electrical equipment for measurement, control, and laboratory use

(Safety regulations for lighting appliances) Machinery

(Safety regulations for lighting appliances) Thermology

Electricity (Safety Regulations for Lighting Appliances)

(Safety regulations for lighting appliances) Materials

Electromagnetic compatibility (EMC) testing

Lamp performance testing

Photometer test (IES test)

Photobiosafety testing

Integral Ball Test

(Safety regulations for lighting appliances) Optics

Smart Home Product Testing

Basic testing of household appliances

Structural inspection

Kitchen appliance testing

Beauty and Hair Testing

Household appliance testing

Energy saving testing of household appliances

Switch product inspection

Plug and socket detection

Electronic control device detection

Automotive interior and exterior components (non electronic and electrical components) - Physical performance testing

Automotive interior and exterior trim - Environmental testing

Automotive interior and exterior components (non electronic and electrical components) - Material aging performance testing

Automotive interior and exterior decorations (electronic and electrical components) - IP protection

Packaging Material Testing - ISTA 1A-6A

Automotive electronic and electrical components - Electrical performance

Automotive interior and exterior trims - Mechanical performance testing

E-mark certification

EMC Testing

Electrical performance testing

Hazardous substance testing

Consumer Product Chemistry

Ecological textile testing

Inspection of luggage and shoe materials

Food contact material testing

Testing of infant and toddler products

Toy product testing

Mechanical inspection

Temperature, humidity and other weather resistance testing

Noise and Vibration

Environmental consulting services

wastewater

Air and exhaust gas

Soil and sediment

solid waste

Battery performance testing

Portable device battery testing

Portable electric vehicle battery testing

Energy storage battery detection

Child protective packaging testing

battery test

EMC testing

Security testing

Notification, Certification, and Compliance

Consumer Product Testing/Notification Services - Electronic Cigarette Special Section

Chemical testing

Wireless Communication

Electromagnetic compatibility

Automotive Electronics

Automotive Parts Inspection

Electronic appliances

Chemical Testing

Electronic Cigarette Testing

Reliability testing

Environmental Testing

Battery Testing

Lamp Inspection

Children's toy testing

China Certification

Asia Certification

European Certification

North American Certification

Middle East Certification

Australia Certification

Africa Certification

Registration and filing of wireless communication products

Energy efficiency registration and filing

Registration and filing of chemical products

Management System Standards Training

TRAINING

system certification

Laboratory design and construction

Wireless product testing

BQB testing

Audio/Video, Information and Communication Technology Equipment

inverter

Power supply for control transformers and built-in control transformers

Medical Electrical Equipment

Electrical equipment for measurement, control, and laboratory use

(Safety regulations for lighting appliances) Machinery

(Safety regulations for lighting appliances) Thermology

Electricity (Safety Regulations for Lighting Appliances)

(Safety regulations for lighting appliances) Materials

Electromagnetic compatibility (EMC) testing

Lamp performance testing

Photometer test (IES test)

Photobiosafety testing

Integral Ball Test

(Safety regulations for lighting appliances) Optics

Smart Home Product Testing

Basic testing of household appliances

Structural inspection

Kitchen appliance testing

Beauty and Hair Testing

Household appliance testing

Energy saving testing of household appliances

Switch product inspection

Plug and socket detection

Electronic control device detection

Automotive interior and exterior components (non electronic and electrical components) - Physical performance testing

Automotive interior and exterior trim - Environmental testing

Automotive interior and exterior components (non electronic and electrical components) - Material aging performance testing

Automotive interior and exterior decorations (electronic and electrical components) - IP protection

Packaging Material Testing - ISTA 1A-6A

Automotive electronic and electrical components - Electrical performance

Automotive interior and exterior trims - Mechanical performance testing

E-mark certification

EMC Testing

Electrical performance testing

Hazardous substance testing

Consumer Product Chemistry

Ecological textile testing

Inspection of luggage and shoe materials

Food contact material testing

Testing of infant and toddler products

Toy product testing

Mechanical inspection

Temperature, humidity and other weather resistance testing

Noise and Vibration

Environmental consulting services

wastewater

Air and exhaust gas

Soil and sediment

solid waste

Battery performance testing

Portable device battery testing

Portable electric vehicle battery testing

Energy storage battery detection

Child protective packaging testing

battery test

EMC testing

Security testing

Notification, Certification, and Compliance

Consumer Product Testing/Notification Services - Electronic Cigarette Special Section

Chemical testing

Wireless Communication

Electromagnetic compatibility

Automotive Electronics

Automotive Parts Inspection

Electronic appliances

Chemical Testing

Electronic Cigarette Testing

Reliability testing

Environmental Testing

Battery Testing

Lamp Inspection

Children's toy testing

China Certification

Asia Certification

European Certification

North American Certification

Middle East Certification

Australia Certification

Africa Certification

Registration and filing of wireless communication products

Energy efficiency registration and filing

Registration and filing of chemical products

Management System Standards Training

TRAINING

system certification

Laboratory design and construction

Wireless product testing

BQB testing

Audio/Video, Information and Communication Technology Equipment

inverter

Power supply for control transformers and built-in control transformers

Medical Electrical Equipment

Electrical equipment for measurement, control, and laboratory use

(Safety regulations for lighting appliances) Machinery

(Safety regulations for lighting appliances) Thermology

Electricity (Safety Regulations for Lighting Appliances)

(Safety regulations for lighting appliances) Materials

Electromagnetic compatibility (EMC) testing

Lamp performance testing

Photometer test (IES test)

Photobiosafety testing

Integral Ball Test

(Safety regulations for lighting appliances) Optics

Smart Home Product Testing

Basic testing of household appliances

Structural inspection

Kitchen appliance testing

Beauty and Hair Testing

Household appliance testing

Energy saving testing of household appliances

Switch product inspection

Plug and socket detection

Electronic control device detection

Automotive interior and exterior components (non electronic and electrical components) - Physical performance testing

Automotive interior and exterior trim - Environmental testing

Automotive interior and exterior components (non electronic and electrical components) - Material aging performance testing

Automotive interior and exterior decorations (electronic and electrical components) - IP protection

Packaging Material Testing - ISTA 1A-6A

Automotive electronic and electrical components - Electrical performance

Automotive interior and exterior trims - Mechanical performance testing

E-mark certification

EMC Testing

Electrical performance testing

Hazardous substance testing

Consumer Product Chemistry

Ecological textile testing

Inspection of luggage and shoe materials

Food contact material testing

Testing of infant and toddler products

Toy product testing

Mechanical inspection

Temperature, humidity and other weather resistance testing

Noise and Vibration

Environmental consulting services

wastewater

Air and exhaust gas

Soil and sediment

solid waste

Battery performance testing

Portable device battery testing

Portable electric vehicle battery testing

Energy storage battery detection

Child protective packaging testing

battery test

EMC testing

Security testing

Notification, Certification, and Compliance

Consumer Product Testing/Notification Services - Electronic Cigarette Special Section

Chemical testing

Portugal will impose taxes on nicotine bags starting from 2026

Author.

LCS

Source:

Post time:

2025-12-12

Portugal added Article 104.0-D to the CIEC Tax Law of the Special Consumption Tax Code in Proposal 37/XVI/1 for Or ç amentodo Estadopara 2026 (National Budget for 2026), which includes nicotine bags in the tax chapter. Here are the tax requirements for nicotine bags and e-liquids in Portugal.

Definition of Nicotine Bag

Nicotine bag refers to a product containing natural nicotine, individually packaged in a bag or other unit device, containing up to 12mg nicotine, without any form of tobacco, designed to be placed in the mouth to release nicotine absorbed by the mucosa.

Image source: Or ç amentodo Estadopara 2026 proposal from Portugal

Nicotine bag taxation standard

The tax unit for nicotine bags is grams, and the tax rate is 0.065 euros per gram.

◆ Note: To determine the applicable tax amount, if the weight of a single package (in grams) is a decimal, the weight should be rounded to:

a. When the first decimal digit is equal to or greater than 5, round up to the last integer;

b. When it is less than 5, round down to the nearest integer.

Image source: Or ç amentodo Estadopara 2026 proposal from Portugal

Taxation Standards for Electronic Cigarette Liquids

Specific taxes will be levied on the liquid in containers used for filling and replenishing electronic cigarettes, with the unit of taxation being milliliters and the tax rates as follows:

a. Nicotine containing liquid: 0.351 euros/milliliter;

b. Nicotine free liquid: 0.175 euros per milliliter.

To determine the applicable tax amount, if the volume of a single package (expressed in milliliters) is a decimal, the volume should be rounded to:

a. When the first decimal digit is equal to or greater than 5, round up to the last integer;

b. When it is less than 5, round down to the nearest integer.

For the liquid in containers of non reusable electronic cigarettes, the equivalent calculation shall be based on 0.05 milliliters of liquid per cigarette and shall not be less than:

a. For liquids containing nicotine, the minimum tobacco tax levied on cigarettes sold at a weighted average price, as stipulated in Article 103 (5), shall be 25%.

b. For nicotine free liquids, the minimum tobacco tax levied on cigarettes sold at a weighted average price, as stipulated in Article 103 (5), shall be 12.5%.

The tax levied on liquids in reusable e-liquid containers may be less than two-thirds of the amount specified in item a or b of the preceding paragraph, applicable to liquids containing or not containing nicotine.

Image source: Portuguese Law 73/2010

Related articles

New articles

Media Center

Latest News

Contact Us

National 24-hour service hotline

400-116-2629

Group Headquarters

E-mail: webmaster@lcs-cert.com

Address: Shenzhen City, Baoan District, Shajing Street, Nga side of the school of Wei Juji Industrial Park, Building A 1 ~ 2 floor, Building C 3 floor

Contact Us

National 24-hour service hotline

Address:Juji Industrial Park, Xueziwei, Ngabian, Shajing Street, Baoan District, Shenzhen Building A 1~2F, Building C 3F

WeChat public number

Share industry dry goods

WeChat consultation

Please note consulting services

Follow Jitterbug

Mobile website

di complaint mailbox: customer.complaint@lcs-cert.com complaint telephone tel: 18126445450 certificate report verification of authenticity mailbox: verification@lcs-cert.com

Wireless and communication detection

Wireless and communication detection

Mobile communication product certification

Mobile communication product certification

Bluetooth BQB Product Certification

Bluetooth BQB Product Certification

FM/AM Product Certification

FM/AM Product Certification

WiFi Product Certification

WiFi Product Certification

Wireless charging product certification

Wireless charging product certification

Interphone product certification

Interphone product certification

Base station certification

Base station certification

SAR testing

SAR testing

Receiver Product Certification

Receiver Product Certification

5G NR Product Certification

5G NR Product Certification

UWB Product Certification

UWB Product Certification

Internet of Things authentication

Internet of Things authentication

Automotive Electronics EMC Testing

Automotive Electronics EMC Testing

EMC rectification

EMC rectification

EMC

EMC

Electrical performance testing

Electrical performance testing

EMS testing - radiation anti-interference testing system (including radar waves)

EMS testing - radiation anti-interference testing system (including radar waves)

EMS Testing - Electrostatic Discharge

EMS Testing - Electrostatic Discharge

EMS Test - Transient Conducted Immunity Test

EMS Test - Transient Conducted Immunity Test

EMS Testing - Portable Transmitter Immunity

EMS Testing - Portable Transmitter Immunity

EMS Test - High Current Injection (BCI) Test

EMS Test - High Current Injection (BCI) Test

EMS test - low-frequency magnetic field anti-interference test

EMS test - low-frequency magnetic field anti-interference test

EMI Testing - Transient Conducted Emissions Testing System

EMI Testing - Transient Conducted Emissions Testing System

EMI testing - low-frequency magnetic field emission

EMI testing - low-frequency magnetic field emission

EMI Test - Radiation Emission Test

EMI Test - Radiation Emission Test

EMI Test - Conducted Emissions Test

EMI Test - Conducted Emissions Test

Automotive Electronic Testing

Automotive Electronic Testing

Automotive ELV&VOC

Automotive ELV&VOC

Reliability testing

Reliability testing

Temperature shock test

Temperature shock test

Vibration testing

Vibration testing

Instrument panel/instrument panel three comprehensive vibration test

Instrument panel/instrument panel three comprehensive vibration test

Comprehensive vibration test of door inner panel III

Comprehensive vibration test of door inner panel III

Sunvisor Three Comprehensive Vibration Test

Sunvisor Three Comprehensive Vibration Test

Spoiler Three Comprehensive Vibration Test

Spoiler Three Comprehensive Vibration Test

Three comprehensive vibration tests of car front and rear bumpers

Three comprehensive vibration tests of car front and rear bumpers

Three comprehensive vibration tests for lamp housing/lampshade

Three comprehensive vibration tests for lamp housing/lampshade

Comprehensive vibration test of outer circumference three

Comprehensive vibration test of outer circumference three

Automotive metal material testing

Automotive metal material testing

Performance testing of automotive lighting fixtures

Performance testing of automotive lighting fixtures

Rapid temperature change test

Rapid temperature change test

Vibration

Vibration

Common issues with vibration testing

Common issues with vibration testing

Common issues with fatigue testing

Common issues with fatigue testing

Common issues with high and low temperature testing

Common issues with high and low temperature testing

Conducted Interference (CE) - Suzhou Lixun Standard

Conducted Interference (CE) - Suzhou Lixun Standard

Electromagnetic Radiation Tolerance Test (RS) - Suzhou LCS Standard

Electromagnetic Radiation Tolerance Test (RS) - Suzhou LCS Standard

Electrical Fast Pulse Withstand Test (EFT) - Suzhou LCS Standard

Electrical Fast Pulse Withstand Test (EFT) - Suzhou LCS Standard

Voltage flicker test - Suzhou LCS standard

Voltage flicker test - Suzhou LCS standard

Household appliance product testing

Household appliance product testing

Electrical accessory product testing

Electrical accessory product testing

Household appliance testing

Household appliance testing

Consumer Product Testing Services - WEEE Chapter

Consumer Product Testing Services - WEEE Chapter

Ecological textile testing

Ecological textile testing

Leather Footwear Inspection

Leather Footwear Inspection

Food contact material testing

Food contact material testing

Testing of toys and baby products

Testing of toys and baby products

Hazardous substance testing

Hazardous substance testing

Electronic cigarette detection

Electronic cigarette detection

Other tests - pencil hardness test

Other tests - pencil hardness test

Mechanical testing - Packaging compression test

Mechanical testing - Packaging compression test

Climate environment testing - Xenon lamp aging test

Climate environment testing - Xenon lamp aging test

Water Quality Testing

Water Quality Testing

environment detection

environment detection

Power storage battery testing and certification

Power storage battery testing and certification

Consumer Electronics Battery Testing and Certification

Consumer Electronics Battery Testing and Certification

Battery

Battery

Light electric vehicle batteries

Light electric vehicle batteries

Energy storage battery

Energy storage battery

Portable battery

Portable battery

Battery testing

Battery testing

battery test

battery test

COI Index Test for Medical Indoor Lighting

COI Index Test for Medical Indoor Lighting

Lamp safety inspection

Lamp safety inspection

Luminaire energy efficiency testing

Luminaire energy efficiency testing

EMC testing of lighting fixtures

EMC testing of lighting fixtures

Integral Ball Laboratory

Integral Ball Laboratory

Photobiology Experiment

Photobiology Experiment

Light distribution test

Light distribution test

Lamp aging test

Lamp aging test

Lamp IP waterproof

Lamp IP waterproof

Lamp performance testing

Lamp performance testing

Lamp reliability testing

Lamp reliability testing

Testing standards for toy products

Testing standards for toy products

China's "national promotion" RoHS certification

China's "national promotion" RoHS certification

China Energy Efficiency Label Certification

China Energy Efficiency Label Certification

China Energy Conservation Certification

China Energy Conservation Certification

China CQC Certification

China CQC Certification

Tmall JD Quality Inspection Report

Tmall JD Quality Inspection Report

China SRRC Certification

China SRRC Certification

Taiwan BSMI certification

Taiwan BSMI certification

Taiwan NCC certification

Taiwan NCC certification

China CCC Compulsory Certification

China CCC Compulsory Certification

KC certification

KC certification

KUCAS Certification in Kuwait

KUCAS Certification in Kuwait

Vietnam COC certification

Vietnam COC certification

Singapore PSB certification

Singapore PSB certification

Iraq COC Certification

Iraq COC Certification

Qatar COC Certification

Qatar COC Certification

Iran COI certification

Iran COI certification

GCC Certification for Gulf Seven Countries

GCC Certification for Gulf Seven Countries

IMDA certification

IMDA certification

VCCI Certification in Japan

VCCI Certification in Japan

JATE certification in Japan

JATE certification in Japan

PSE certification

PSE certification

BIS certification

BIS certification

Japanese TELEC certification

Japanese TELEC certification

GOST certification in Russia

GOST certification in Russia

Russian EAC certification

Russian EAC certification

Northern Ireland UKNI logo

Northern Ireland UKNI logo

Electrical ENEC certification

Electrical ENEC certification

European D-MARK certification

European D-MARK certification

Türkiye BTK certification

Türkiye BTK certification

TSE certification in Türkiye

TSE certification in Türkiye

CE certification in Türkiye

CE certification in Türkiye

RED certification

RED certification

German TUV-SUD certification

German TUV-SUD certification

REACH certification

REACH certification

German GS certification

German GS certification

EU E-Mark certification

EU E-Mark certification

Ecuador VOC certification

Ecuador VOC certification

Mexico NOM certification

Mexico NOM certification

IRAM certification

IRAM certification

CPSC Certification in the United States

CPSC Certification in the United States

ASTM certification

ASTM certification

FDA certification

FDA certification

CEC certification

CEC certification

ETL certification

ETL certification

ul certification

ul certification

IC certification

IC certification

Energy Star

Energy Star

FCC Certification in the United States

FCC Certification in the United States

UL, ETL, CSA, MET, TUV certification in the United States

UL, ETL, CSA, MET, TUV certification in the United States

ASTM certification

ASTM certification

Saudi SABER certification

Saudi SABER certification

Saudi SABER Certification Gulf Seven GCC Certification

Saudi SABER Certification Gulf Seven GCC Certification

Iran COI certification

Iran COI certification

Qatar COC Certification

Qatar COC Certification

Iran COI certification

Iran COI certification

Qatar COC Certification

Qatar COC Certification

Iraq COC Certification

Iraq COC Certification

Saudi EER Energy Efficiency Certification

Saudi EER Energy Efficiency Certification

Saudi SABER certification

Saudi SABER certification

Saudi EER Energy Efficiency Certification

Saudi EER Energy Efficiency Certification

Algeria PCA certification

Algeria PCA certification

PVOC certification

PVOC certification

New Zealand IC-F testing

New Zealand IC-F testing

VEET certification

VEET certification

LCP certification

LCP certification

GEMS certification

GEMS certification

RCM certification

RCM certification

C-Tick certification

C-Tick certification

SAA certification

SAA certification

Gabon COC certification

Gabon COC certification

Algeria COC certification

Algeria COC certification

Ethiopian VOC and COC certification

Ethiopian VOC and COC certification

Mauritius VOC certification

Mauritius VOC certification

Ghana COC certification

Ghana COC certification

COC certification in Burundi

COC certification in Burundi

Zambia COC certification

Zambia COC certification

Botswana COC Certification

Botswana COC Certification

Uganda PVOC certification

Uganda PVOC certification

SABS certification in South Africa

SABS certification in South Africa

South African LOA certification

South African LOA certification

Zimbabwe CBCA Certification

Zimbabwe CBCA Certification

Nigeria SONCAP certification

Nigeria SONCAP certification

Kenya PVOC certification

Kenya PVOC certification

African COC certification

African COC certification

WEEE

WEEE

Bluetooth BQB certification

Bluetooth BQB certification

IECEE registration

IECEE registration

MHRA registration in the UK

MHRA registration in the UK

Management system training

Management system training

Laboratory technical training

Laboratory technical training

Laboratory Process Consulting

Laboratory Process Consulting

Laboratory decoration construction

Laboratory decoration construction

WeChat Inquiry

WeChat Inquiry